If goods are re-exported to the United States via Southeast Asia, the total cost could be higher than exporting directly from China, potentially forcing these companies to abandon these markets.

After China's countermeasures, the PLA tariff of the United States exports to China increased by 34%, calculated at the unit price of 17,200 yuan/ton in 2024, superimposed on the previous tax rate adjustment, the unit price of entering the Chinese market soared to 23,500 yuan/ton, and the competitiveness was greatly reduced.

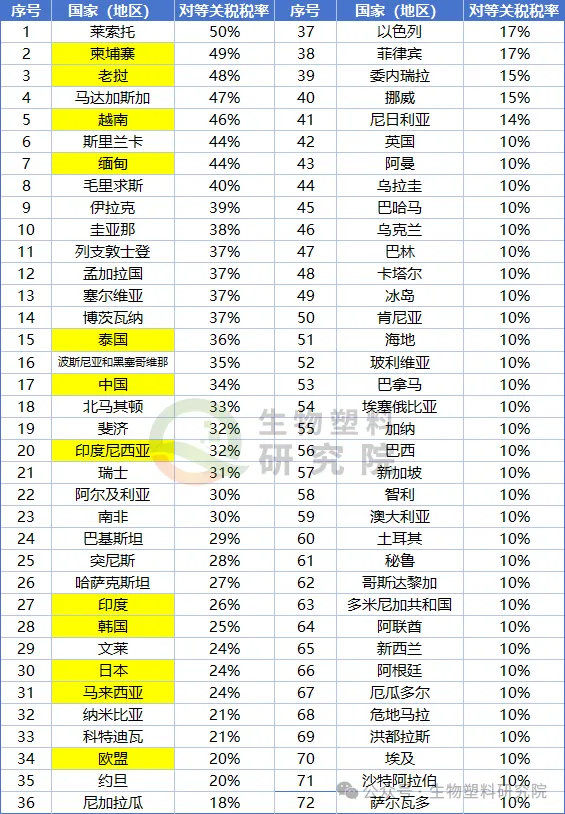

On April 2, 2025, US Eastern Time, US President Trump announced tariffs on 185 countries, causing a global shock.

1. Analysis of US tariff policy

The US tariff adjustment policy is complex and far-reaching. On the one hand, the benchmark tariff of 10% is set for all imported goods, and the auto tariff is increased to 25%, and officially took effect at 0:01 am Eastern time on April 5 (12:01 am Beijing time on April 5). On the other hand, the implementation of differentiated tax rates for major trading partners is divided into three levels:

The first would impose a minimum base tariff of 10% on all imports and 25% on imported cars.

The second would impose higher tariffs on some trading partners. Among them, Cambodia has been added 49%, Laos 48%, Vietnam 46%, Myanmar 44%, Iraq 39%, Bangladesh 37%, Thailand 36%, China 34%, the European Union 20%, Japan 24%, South Korea 25%, higher tariffs are expected to be implemented on April 9.

The third (preferential file), the relevant enterprises to move factories to the United States, can be exempted from tariffs.

2. Multinational countermeasures

The US tariff policy triggered a global chain reaction, and many countries quickly responded:

China: On April 4, The State Council Tariff Commission imposed a 34% tariff on all imports originating in the United States from April 10. At the same time, a series of combination measures such as rare earth export control and anti-dumping investigations have been implemented.

European Union: European Commission President Ursula von der Leyen warned that U.S. tariffs would have "dire consequences" for the global economy and activated a countermeasure mechanism. Tariffs on 26 billion euros worth of U.S. goods will be imposed in two phases, with the first phase starting April 1 targeting Harley motorcycles, bourbon whiskey, orange juice and more. The second phase was expanded to include aircraft parts and agricultural products in mid-April, and the scale of retaliation is comparable to the US tariffs.

Japan and South Korea: Although they expressed "extreme regret", Japan did not take substantive countermeasures, and South Korea implemented a "tariff shock buffer plan" by subsidizing its auto and semiconductor industries.

Southeast Asian countries: As a hard-hit area, Vietnam's General secretary Su Lin talked with Trump on April 4 and proposed to reduce import tariffs on the United States to 0% in order to compromise with the United States, but the United States has not yet let go and still maintains a 46% tax rate. Countries such as Thailand and Cambodia face high tariffs of 36% to 49%, which may cause the supply chain of industries such as textiles and electronics to shift.

3, China's entrepot trade is blocked, leaving Southeast Asia?

During the previous Sino-US trade war, the entrepot trade mode of "China → Southeast Asia → the United States" effectively reduced the impact of the trade war. Data for 2024 show that China's total exports to ASEAN reached $586.524 billion (up 12%), surpassing exports to the United States ($524.656 billion, up 4.9%) and the European Union ($516.461 billion, up 3%), making ASEAN China's largest single export market. In the same year, Vietnam's exports to the United States reached a record high of $123.6 billion, with many Chinese products entering the US market via Southeast Asia.

However, after the adjustment of US tariffs, Cambodia (49%), Laos (48%), Vietnam (46%), Myanmar (44%), Thailand (36%) and other countries have higher tariffs than China (34%), and the cost of re-export has risen sharply. In the case of Vietnam's re-export, the total cost of goods may be higher than exporting directly from China. Companies will need to re-evaluate the economic viability of re-exports, which may even force them to abandon these markets.

Even if Southeast Asian countries in the future, as Vietnam hopes, succeed in obtaining "reciprocal zero tariffs" (currently Vietnam has not succeeded), or obtain low tariffs by transferring part of the benefits, the United States has strengthened the review of "third country re-exports". The United States requires goods to be substantively processed in Southeast Asian countries (such as changing the tax code and reaching the value-added ratio) in order to enjoy lower tariffs. If it is simply assembled or labeled, it may still be traced back to "Chinese origin" and subject to high tariffs.

The dilemma is particularly pronounced in the plastic packaging industry. Companies such as Yutong Technology (002831), Hengxin Life (301501), Zhongxin Shares (603091), Jialun Technology (301193), and Wang Zi New Materials (002735), although they have set up factories in Southeast Asia for many years, it is still difficult to resist the cost increase and profit compression caused by high tariffs in the United States, and the third policy of the United States is due to high labor costs. The plastic packaging industry has limited appeal for small profits and quick sales.

4, China's plastics industry under pressure, export costs surge, polylactic acid but benefit?

The United States is an important export market for Chinese plastic products, and in 2024, China's exports of plastics and their products to the United States reached $141.192 billion, accounting for 16.76% of the total exports. The United States imposed 34% tariffs on Chinese plastic materials, superimposed transportation, logistics and other costs rose, and the profit margin of Chinese plastic enterprises was compressed by 15%-20%. Merchants in Yiwu's small commodity market negotiate tariff sharing with American customers, and some enterprises try to raise prices to pass on the cost.

In the face of the difficulties of the US market, some enterprises have turned to the EU market, but the EU economy has faced recession pressure in recent years, and the EU plastic imports fell 5.2% year-on-year in 2024. The US tariff policy has made China's plastic exports face a "double contraction of the US and Europe" situation, and it is difficult to expand the market.

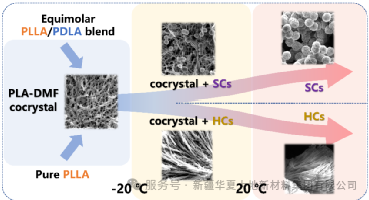

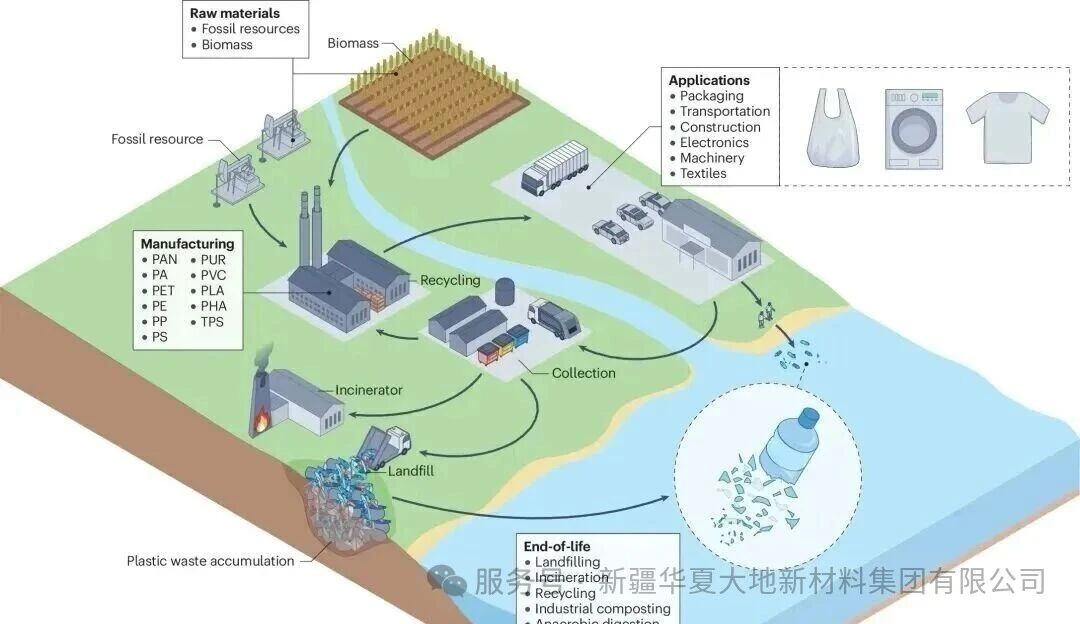

Biodegradable plastics are a special case. In 2024, China's production of biodegradable plastics exceeded 300,000 tons, and the amount of polylactic acid (PLA) exported from China to the United States was rare (13 tons in 2023 and 12 tons in 2024), and the impact of US tariffs was small. On the contrary, China imports a large amount of PLA from the United States, 19,000 tons in 2023 and 23,000 tons in 2024. After China's countermeasures, the PLA tariff of the United States exports to China increased by 34%, calculated at the unit price of 17,200 yuan/ton in 2024, superimposed on the previous tax rate adjustment, the unit price of entering the Chinese market soared to 23,500 yuan/ton, and the competitiveness was greatly reduced.

In terms of PBAT, China exports 186 tons to the United States in 2023 and 523 tons in 2024; The amount of US exports to China is very small, 11 tons in 2023 and 14 tons in 2024, and the impact on the overall trade pattern is negligible.

However, some listed companies in the degradation industry are still affected, such as Jindan Technology lactic acid and its series of products to the United States export tariffs as high as 50.1%. Jindan Technology said that the increase in tariffs will directly lead to the increase in the cost of the company's products exported to the United States, and the company needs to pay higher tariffs. In addition, the increase in tariffs may also affect the company's sales strategy and pricing strategy, and the company's export products may need to increase the price of products to a certain extent to cope with the increase in costs.

Jindan Technology will formulate corresponding countermeasures according to the actual situation:

(1) The Company will continue to optimize product mix, implement differentiated product mix strategies, and improve product added value and economic benefits.

(2) Further strengthen cost control and management, and reduce production costs by optimizing production processes, improving production efficiency, and reducing raw material procurement costs.

(3) Adhere to the expansion of key foreign markets, accelerate the implementation of international strategic layout, and consolidate and improve the operation quality and management level of European companies.

(4) The Company will continue to increase investment in technology research and development and innovation, improve product quality and service level, so as to better respond to market changes and the impact of tariff policies.

In general, the US tariff policy has intensified the uncertainty of the global industrial chain. While the European plastics industry is declining due to high costs and regulatory pressure, China is improving its competitiveness through technological upgrading and market diversification (to explore European and "Belt and Road" markets). Degradable plastics as a key area of green transformation, although short-term impact, but long-term benefit from the global "plastic ban" trend, the future development is still worth looking forward to.