83

83

1. Lactic acid upstream industry situation

At present, the fermentation substrate used in the domestic production of lactic acid is mainly starch sugar extracted from corn and other crops, so the corn crop planting industry is the upstream industry of lactic acid industry chain. The consumption uses of corn include feeding, industrial consumption, edible consumption and seed use. From the trend point of view, China's corn feeding consumption as a whole showed a downward trend, industrial consumption continued to rise.

(1) Domestic corn market in the first half of 2024

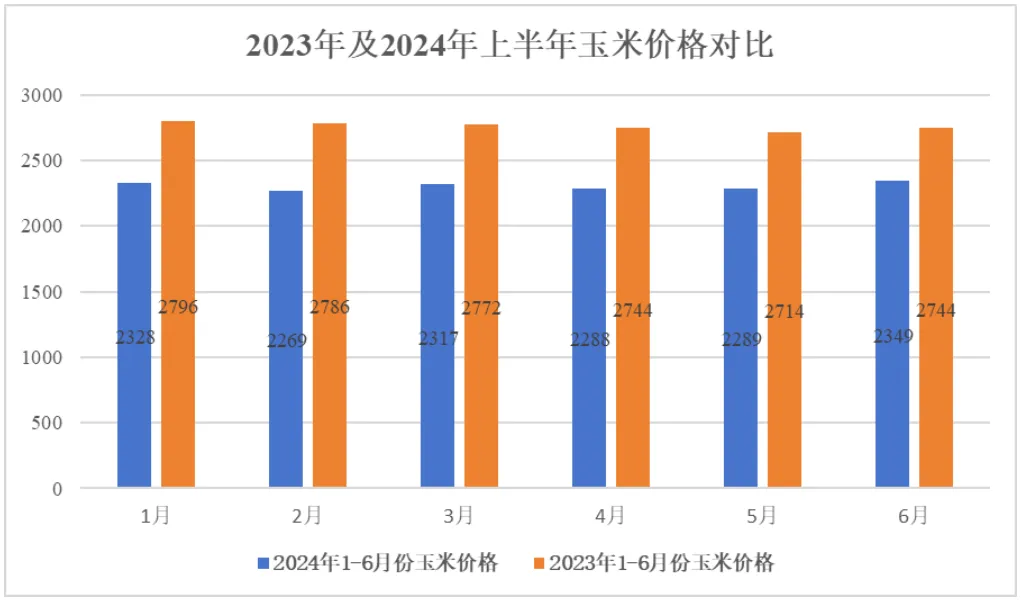

After the new corn came on the market in the second half of 2023, the price of corn futures fell sharply. In January 2024, the China Grain Storage Group publicly announced that it would increase the purchase and storage scale of new corn, and after the Spring Festival, corn prices began to rebound, and the overall corn market price in the first half of 2024 showed a "W" trend.

According to the statistics of Baichuan Yingfu, as of June 28, the purchase price of domestic corn enterprises was 2.375 yuan/ton, down 39 yuan/ton from the beginning of the year, down 1.62%, and the average market price in the first half of 2024 was 2.307 yuan/ton, down 16.38% from the same period last year. In the first half of 2024, the national wheat harvest is gradually completed, but wheat prices have continued to fall since October 2023, and the overall supply pattern is loose. According to Zhuo Chuang information data show that in the first half of 2024, the average price of wheat in the main producing areas (the second class of the national standard) is 2.673.22 yuan/ton, down 9.61% year on year, so the substitution role of wheat for corn is gradually strengthened.

According to the statistics of Hua 'an Securities, from December 2022 to March 2024, the cumulative decrease of sow stock was 9.1%, and the decrease of breeding sow stock was transmitted to the pig market from October to December 2024. It is expected that the pig market volume in 2024 will decline compared with that in 2023, and the feed demand will be reduced under the influence of the breeding industry. As a result, the use of corn in the feed industry has declined.

(2) Main influencing factors of corn market in the second half of 2024

According to USDA forecasts, the United States, Ukraine, Argentina and other major corn producing countries are expected to reduce production, and the global corn production has declined in the 24/25 year, and the supply and demand margin has tightened. In 24125, China's corn output reached 292 million tons, an increase of 3.16 million tons over 23/24, an increase of 1.09%, reaching the highest level in history. In 24/25, China's ending corn inventory of 213 million tons, an increase of 1.98 million tons over 23/24, an increase of 0.94%, the highest level since 18/19.

According to the statistics of Shanghai Steel Union and Hua 'an Securities Research Institute, from June 15, 2024 to June 21, 2024, 126 major deep processing enterprises in the country consumed 1.186 million tons of corn, a decrease of 57,200 tons from the previous month; Among them, the consumption of corn starch processing enterprises was 597,000 tons, a decrease of 27,500 tons from the previous month; the consumption of corn alcohol processing enterprises was 393,000 tons, a decrease of 20,300 tons from the previous month; Amino acid processing enterprises consumed 196,000 tons, a quarter-on-quarter reduction of 0.9400 tons of starch, alcohol processing enterprises at a loss, dragging down corn consumption, deep processing demand performance weak.

In the third quarter of 2024, the demand for corn deep processing is weak, and with the continued decline in wheat prices, the consumption of corn feed is also expected to decrease, on the other hand. Downstream deep processing and feed enterprises inventory is relatively sufficient, the fourth quarter new season corn after the market pressure on the supply side, is expected to show a weak trend in the second half of the year.

2. Lactic acid industry

As an important organic acid with a long history, lactic acid and its salts and other derivatives have been widely used in food, medicine, feed, chemical industry and other traditional applications. Lactic acid polylactic acid (PLA) produced by polypolymerization reaction as an environmentally friendly and green new biodegradable material in recent years, in textiles, plastics, packaging, agricultural mulch, modern medicine, 3D printing, consumer electronics, automotive, agriculture/horticulture. Emerging application fields such as textiles have broad application prospects, and have played an important role in promoting economic and social development.

According to the data of the General Administration of Customs, PRC, in the first half of 2017-2024, the export volume of lactic acid and its salts and esters in China is greater than the import volume, and the export volume is higher than the import volume, and the import volume and export volume of lactic acid and its salts and esters in 2017-2022 maintain an overall growth trend; In 2023, the import value of lactic acid and its salts and esters increased by 15.75%, but the export value decreased by 15.11%.

In the first half of 2024, the import amount of lactic acid and its salts and esters in China was $16,053,700, down 19.42% from the same period last year, and the export amount was $7,129.14 million, up 5.26% from the same period last year. Therefore, in the first half of 2024, China's international trade surplus of lactic acid and its salts and esters will further increase, which is conducive to reducing domestic lactic acid inventory and easing domestic lactic acid market competition.

Global lactic acid production enterprises are mainly concentrated in the United States, China, Thailand, Western Europe, Central and South America and Japan, and most of the manufacturers use microbial fermentation for production. Biological fermentation is the main process of lactic acid production, and fermentation control and separation and purification are the technical difficulties. At present, the global research and development direction of lactic acid and its derivatives is mainly low cost, high yield, high quality and pollution-free. Therefore, improving the fermentation conversion rate and product quality of lactic acid, and reducing by-product generation and environmental pollution are the keys to maintain sustainable development of lactic acid production enterprises. As the market with the largest demand for lactic acid in the future, the update of polylactic acid production technology is still the research and development direction of enterprises in the industry, so as to form a virtuous cycle of common development of lactic acid and polylactic acid.

3. Development status of lactic acid downstream industry

(1) Biodegradable industry policy

Plastic is one of the most important materials in the modern chemical industry, with the development of the economy, consumption upgrading and the rapid development of the express industry and take-out industries, plastic has become a necessity in our daily life, such as express packaging, takeaway tableware, supermarket shopping bags, agricultural mulch and so on. However, the waste plastic products after use have the characteristics of large quantity, wide distribution and difficult to recycle, forming the "white pollution" problem that is very concerned about the world, not only polluting the environment and endangering health, but also occupying valuable land resources.

According to the National Bureau of Statistics, from January to May 2024, the national plastic products industry output of 30,0028 tons, an increase of 1.0%. In the whole year of 2023, the national plastic products industry output of 74.885 million tons, an increase of 3.0%, according to the China Materials Recycling Association data, in 2023 China's waste plastic recycling amount of 19 million tons, the remaining 55.885 million tons are mainly through landfill, incineration or abandonment and other ways to deal with.

Incineration is easy to produce toxic and harmful gases, thus causing pollution to the atmosphere, landfill will occupy a large amount of land resources, and seriously hinder the circulation of groundwater and water penetration, directly abandoned to the nature of plastic products degradation time takes hundreds of years, all these ways cause serious damage to the natural environment and will produce the corresponding social cost of waste disposal. And a range of negative environmental and health effects. Therefore, relevant departments have introduced policies to encourage the use and promotion of degradable plastics, and have introduced relevant support policies;

On February 1, 2024, the revised Industrial Structure Adjustment Guidance Catalogue (2024 edition) issued by the National Development and Reform Commission was officially implemented. The Catalogue consists of three categories: encouraging, restricting and eliminating, and the general requirements are to approve, approve or record encouraged projects in accordance with relevant provisions; Among them, polylactic acid fiber (PLA) belongs to the encouraging industrial products that have an important role in promoting economic and social development.

On February 29, 2024, ten departments of the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Natural Resources, the Ministry of Ecology and Environment, the Ministry of Housing and Urban-Rural Development, the Ministry of Transport, the People's Bank of China, the General Administration of Financial Supervision, the China Securities Regulatory Commission, and the National Energy Administration issued the "Green Low-carbon Transformation Industry Guidance Catalogue (2024 edition)". The Catalogue (2024 edition) includes a number of new categories related to degradable plastics and bio-based materials.

On June 4, 2024, The Ministry of Ecology and Environment, together with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Finance, the Ministry of Human Resources and Social Security, the Ministry of Housing and Urban-Rural Development, the Ministry of Transport, the Ministry of Commerce, the People's Bank of China, the State-owned Assets Supervision and Administration Commission of the State Council, the General Administration of Customs, the General Administration of Market Regulation, the General Administration of Financial Supervision, the China Securities Regulatory Commission, and the National Data Administration have formulated the Implementation Plan on Establishing a Carbon Footprint Management System. . The plan proposes that by 2027, the carbon footprint management system will be initially established.

(2) polylactic acid market situation in the first half of 2024

According to statistics, from January to June 2024, the price of mainstream degradable materials is within the range of 12,000 yuan/ton to 60,000 yuan/ton. Polylactic acid manufacturers offer stable, solid offer a single talk.

Import and export situation, from January to May 2023, China's polylactic acid imports 10.620.8 tons: exports 3.189.8 tons. From January to May 2024, China imported 17.346 tons of PLA, up 63.32% year on year; Exports of 8.348 tons, an increase of 161.71%.

(3) The development trend of degradable market

By the end of 2023, China's biodegradable plastic production capacity of about 1.9 million tons, of which PBAT/PBS accounted for 80%PLA accounted for about 15%, China is currently under construction and proposed to build biodegradable material production capacity of more than 10 million tons, will continue to lead the global capacity growth. The company believes that with the gradual maturity of technology, further improvement of industrial support, and improvement of scale, the cost of biodegradable materials will continue to decline, thus accelerating product market promotion. Therefore, the future development trend of the degradable market will revolve around the following four directions:

① Technological progress and cost reduction

In terms of raw material cost, the intermediate material lactide used by domestic enterprises to produce PLA has long relied on imports, and the cost is high. Technological breakthroughs are expected to solve the problem of import substitution, which will help enterprises to reduce costs and improve efficiency. In terms of processing costs, the current problem is that the production scale is small, the processing cost is high, but with the expansion of the scale, the processing cost is expected to be lower. At the same time, some domestic production enterprises use location advantages to reduce costs. For example, the company is located in the main corn producing area of the eastern Henan Plain, the use of local corn crops as raw materials for high-quality lactic acid production, with an annual output of 1.83 million tons of lactic acid and its series of products production capacity, ranking in the industry leader position; At the same time, the company takes advantage of its own advantages to actively build a vertically integrated degradable material industry chain, in order to reduce transportation costs and enhance the comprehensive competitiveness of enterprises.

② The "triad" is broken

Degradable materials in the process of industry development will inevitably appear energy, material and cost conflict, first of all, the future government needs to actively advocate and encourage grain fermentation route upgrade to biomass fermentation route such as straw, to solve the conflict with people to compete for food, and the future PLA production expansion will no longer worry; Secondly, enterprises should realize technological breakthroughs as soon as possible by increasing technological investment, which will bring about production capacity release, cost reduction, and actively promote the alternative role of degradable materials.

③ Application development is gradually diversified

Through the synchronous optimization of the performance, technology and cost of degradable materials to enable the diversified application of degradable materials, the future application of degradable materials can not rely on its non-toxic safety, strong insulation and biodegradable characteristics, but only in the field of disposable products such as food boxes, packaging bags, agricultural mulch, etc. To be able to achieve further improvement of performance through blending and modification, there is hope to replace industrial grade plastics in the medium and long term, and it is applied in 3D printing, biology, medical, electronics and coatings and other fields. At this time, it is necessary for enterprises in the industry to establish optimized and reasonable biodegradable evaluation systems and methods, reflect the actual situation of biodegradable materials in nature, further study the decomposition rate, decomposition thoroughness and degradation process and mechanism of biodegradable materials, develop technologies that can control the degradation rate, and develop and constantly optimize new processes and new technical methods with barriers. Simplify the synthesis route, reduce the production cost, and increase the possibility of wide application. In the context of the continuous maturity of technology, continuous consumer education, stimulate demand, and enhance its penetration in catering, medical, agriculture, construction, industry and other fields.

4. Import substitution will be gradually realized while production capacity will meet domestic demand in the future

According to the statistics obtained by the iResearch Institute on the production capacity of 52 domestic enterprises under construction or proposed, China's degradable material production capacity will reach 4.59 million tons (proposed) in the next 3-5 years, especially the proposed production capacity of PLA can reach about 3 million tons, which can cover the current demand for degradable materials in the catering market, agricultural mulch application and medical scenarios. In addition, the application of degradable materials abroad is earlier than the domestic time, before the promulgation of the "plastic ban", the demand for degradable materials in China is small, and the production capacity of enterprises is mainly used to meet the export demand. The "plastic ban" promotes the surge of enterprises under construction and proposed construction rate, China's degradable materials market will present a dual pattern of domestic consumption and export demand, with the favorable policy and the breakthrough of production technology, domestic enterprises to establish production lines, capacity to meet domestic and export demand at the same time of expansion.